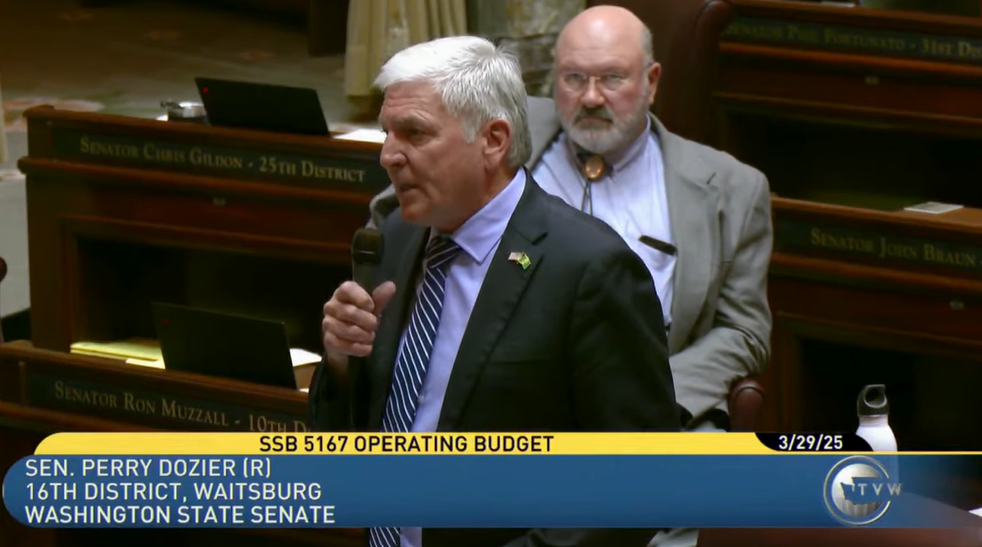

Click here to view my remarks in support of the no-new-taxes, no-cuts budget proposal offered today in the Senate chamber.

Dear Neighbor,

I don’t know why the Senate majority chose today to have us vote on the operating and transportation budgets, but I’d guess it is because both contain tax increases. Maybe they were hoping people would be busy on a Saturday and not paying as much attention.

Let me help call attention to what happened, by sharing the news release I issued today about the budget votes. It tells the story. And keep reading for how you can make your voice heard about the tax proposals themselves.

OLYMPIA, March 29… The record $21 billion in new and higher taxes included in the state Senate’s new operating budget and the gas-tax increase in its new transportation budget kept Sen. Perry Dozier from supporting either plan today.

“Both budgets have their merits, but I can’t overlook the fact that they would also add significantly to a cost of living in our state that is already too high. We can and should do better.

“I’m especially disappointed and concerned that the Democrats’ budget is based partly on tripling the growth rate of state and local property taxes. That contradicts what we’ve been hearing for months, about how the Democrats want to ‘make the wealthy pay what they owe.’ A property-tax increase hits every landowner regardless of their income, and is bad for renters too,” said Dozier, R-Waitsburg.

“We brought the Republican operating-budget proposal to the Senate floor as a common-sense alternative for our Democratic colleagues to consider. It spends less than the amount of revenue coming in, it wouldn’t raise a single tax or cut a single service, and it wouldn’t drain the state’s rainy-day fund. And still, the Democrats said no and went with their plan instead, even though it is the complete opposite of ours in all of those ways.”

The Republican “$ave Washington” plan failed on a 30-19 party-line vote. Senate Democrats then adopted their larger $78.5 billion proposal with a partisan 28-21 vote.

Prior to the final vote, Dozier reminded his Senate colleagues how the Democrat budget is balanced in part by cuts to higher-education funding which will mean tuition increases at the state-run colleges and universities, and other cuts to financial assistance.

“One of the most popular things the Legislature has done in the past decade was to cut tuition, then put a cap on it so students and their families could know what was coming,” he said, referring to a 2015 Republican-led reform that reduced tuition for the first time in state history. “It’s unconscionable for the Democrats to now break the tuition cap when they’re also raising taxes by $21 billion.”

On top of the tuition increase, Dozier explained, the Democrats’ budget cuts support for child care, cuts the state fair fund by 50%, increases hunting and fishing license fees by nearly 40% and hikes the cost of a Discover Pass by 50% — again, at the same time that it would raise taxes by $21 billion.

“I don’t know why the Democrats are so determined to raise taxes when the budget we proposed is proof that tax increases are completely unnecessary.

The state gas tax has been 49.4 cents per gallon since 2016. Dozier said he understands the need for more transportation money, but the proposed 6-cent increase in the Senate transportation package is more complicated than it sounds.

“If the Climate Commitment Act had been repealed in November, that hidden gas tax would be gone, and Washington’s gas prices would be closer to Idaho and Oregon. And if the Democrats weren’t also raising property taxes and so much more in the operating budget, a bump in the gas tax would look different. But this budget also indexes the gas tax, so it would automatically increase each year. All of that together is just too much,” Dozier said.

He said the third of the Senate budget proposals, the capital budget, will be released Monday. Dozier is assistant Republican leader for that budget, which allocates funds for public construction and other capital projects and is generally the most bipartisan of the spending plans legislators must adopt.

Let me recap the Democrat tax proposals that will cost the most:

- SB 5798, which would remove the 1% cap on the annual growth rate of state and local property tax rate, and instead allow your property-tax rate to increase based on inflation plus population growth. That could average 4.5% per year based on recent history, but go as high as 8%.

- SB 5797, called a “wealth” tax by the majority, is actually a new kind of property tax. Instead of taxing people for owning land, it would tax people for simply owning a certain volume of stocks, bonds and other intangible assets. Republicans see it as also discouraging the innovation that is at the heart of Washington’s high-tech sector.

- SB 5796, which would basically mimic the payroll tax already being imposed by the city of Seattle. This new tax would be applied to nearly 5,300 Washington employers: the tech industry, professional services, finance, real estate and health care. My understanding is that it also would hit some public-sector employers, like universities and larger school districts.

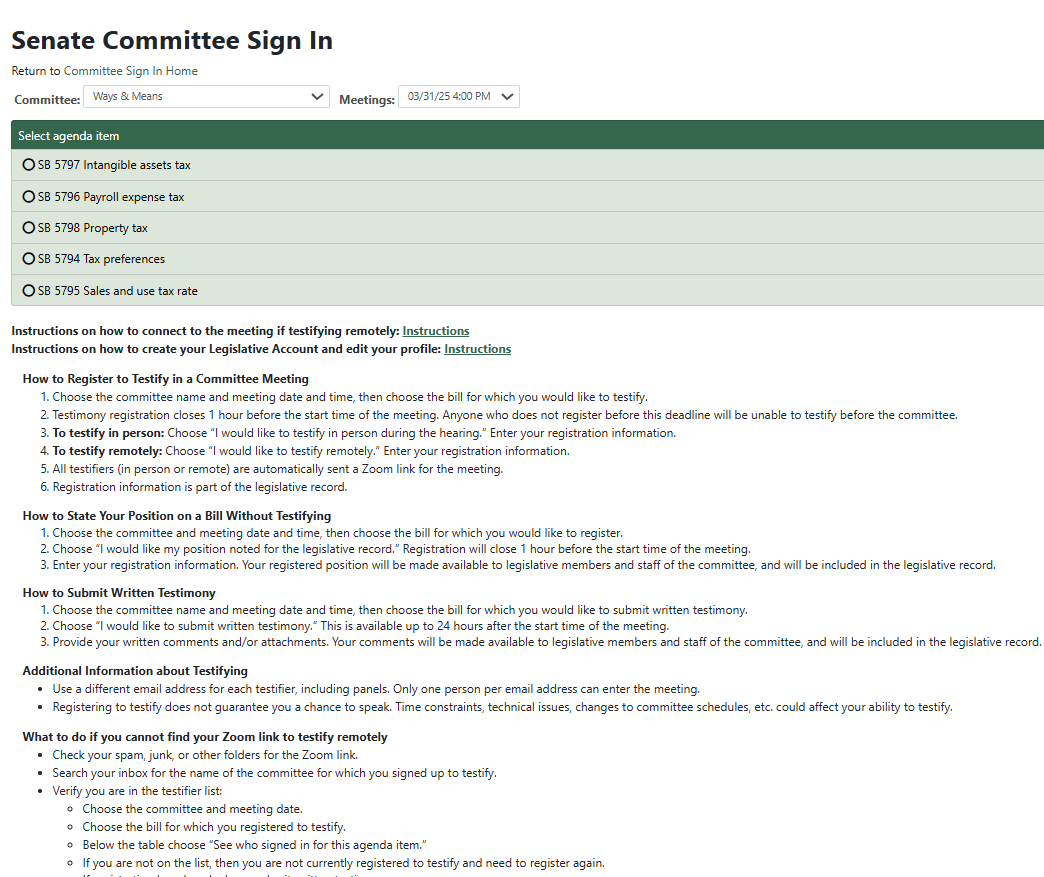

Before 3 p.m. Monday, I encourage you to go online to the Ways and Means Committee sign-in page for these bills. You may state your comment on one or more by clicking here and following what should be a user-friendly process. Here’s where the link will take you:

If you would rather testify instead of simply supplying your position on this legislation, see the link below.

***

I am working to make living in our state more affordable, make our communities safer, uphold our paramount duty to provide for schools, and hold state government accountable. I’ll work with anyone who shares those goals and wants to find solutions.

My priorities (shared by Senate Republicans) are:

Here’s how to:

- Follow the bills I am sponsoring.

- Find out how to testify in committee hearings on bills that are before the Legislature.

Please reach out to my office with your thoughts, ideas and concerns on matters of importance to you. I am here to serve and look forward to hearing from you.

Sincerely,