Chief Rocky Eastman headed the delegation from Walla Walla Fire District #4 that came by this past week. If you expect to be anywhere near the state Capitol between now and the March 7 end of this year’s session, I hope you will contact my office and arrange to stop in!

Dear Neighbor,

Greetings from the state Capitol!

Every session, one of our opening-day tasks is to agree on deadlines for taking action on legislation. Considering nearly 540 bills have been introduced in the Senate alone for 2024, not counting legislation that is still eligible from this past year, this “cutoff” calendar does much to help committee and caucus leaders decide which measures continue on the path to becoming law, and which are put aside.

In my experience, the bills that survive our deadlines tend to fall into three categories: simple bills that make reasonable changes; bills that have potential but need more of the refining that is done through the amendment process; and bills that the majority side wants, which happen to also be majority-sponsored measures much more often than not.

We are nearly at the first cutoff for this year’s legislative session, which is for Senate policy committees to decide the fate of Senate bills referred to them. This is formally known as “executive action,” which I’ll explain below, as it has come up in recent questions and comments from constituents.

Next week brings the cutoff for the two Senate fiscal committees. One is the Ways and Means committee, which handles legislation affecting the operating and capital budgets. Transportation is the second. SB 6238, my bipartisan bill to close a loophole in the state’s list of property-tax exemptions, received a public hearing in Ways and Means this past week; now we just need a vote (although it’s possible this bill could end up being in the package of bills labeled “necessary to implement the budget,” which exempts it from the usual deadlines). My measure specifically concerns a property-tax exemption that was created in 2005 to benefit the widows and widowers of honorably discharged veterans, yet has not kept pace with similar exemptions since then.

A web page showing the legislation I am sponsoring is here. You may choose between bills I’m prime-sponsoring and those for which I am a co-sponsor. For more on my session priorities and legislation, and a shout-out to some former legislators from our 16th Legislative District, read my recent interview in Shift.

Farmworkers rally against ag-overtime law;

labor committee schedules another hearing on reform bill

This past week farmworkers descended on the Capitol to protest the ag-overtime law adopted in 2021 (see photo), basically saying it’s not working for them the way the supporters claimed.

If you want to get legislators’ attention, there’s nothing like holding a rally on the front steps of the Legislative Building and also going inside the Capitol Rotunda. I have no doubt that these very visible demonstrations had an effect on the majority side of the aisle, because the bipartisan ag-overtime reform bill introduced last year (SB 5476) suddenly was scheduled for a public hearing tomorrow before the Senate Labor and Commerce Committee.

This is a nice turn of events, on the surface, but I have to point out how the same committee held a public hearing on SB 5476 this past February, during the 2023 session, then let the bill die. I’m not seeing a committee vote scheduled for the bill this time around, so all sides in our agricultural sector will have to keep their expectations real. That said, if SB 5476 is allowed to die again, the majority has some explaining to do – especially to the farmworker community. I don’t think it could make its concerns any clearer.

For some of the news coverage of the rally, click here and here.

Voters to Legislature: Consider

these six policy changes… this session

Under our state constitution, the state’s legislative authority is “vested” in the Senate and House of Representatives. However, Article II, Section 1 continues with this: “the people reserve to themselves the power to propose bills, laws, and to enact or reject the same at the polls, independent of the legislature.”

This power is exercised through the initiative – either an initiative to the people, which if certified goes straight to the ballot, or an initiative to the Legislature. If certified, an initiative to the Legislature does just what the name implies. It comes to us as legislation which may be enacted, just like any other bill. If an initiative is not enacted, it must go to the ballot alone or to the ballot accompanied by an alternative from legislators, in which case the voters get to choose one.

Our constitution also makes it clear that the Legislature isn’t supposed to just sit on these measures and do nothing: Article II, Section 1 includes a sentence about how initiatives are to “take precedence over all other measures in the legislature except appropriation bills.”

A record six initiatives to the Legislature – twice the previous high, set all the way back in 1972 – have been certified to us by the secretary of state.

- I-2109 would repeal the state tax on income from capital gains. When this came before the Senate for a vote during the 2021 session, I and other Republicans proposed putting the measure before the voters later that year. The majority side said no. We now know from public-records disclosures that supporters of the tax knew its constitutionality would be challenged and saw that lawsuit as a way for the state Supreme Court to open the door to a full-blown income tax, like Oregon has. That strategy failed but for some reason the justices did accept the nonsensical argument that this is not an income tax but rather an “excise” tax. As our Senate Republican budget leader put it in this statement, I-2109’s certification puts it on a path to a public vote… one way or another.

- I-2111 would ban any local or state government in our state from imposing an income tax (Washington voters have in one form or another rejected 11 other attempts to impose an income tax, but I know legislators who have yet to get the message). Like I-2109, this measure has been referred to our Ways and Means Committee. The Senate and House Republican leaders issued this statement about their support for the initiative.

- I-2124 targets the mandatory payroll tax that supports the state-run WA Cares long-term care program. It would not end the program but instead allow workers to opt out, which isn’t possible now. In the Senate, I-2124 has been referred to the Labor and Commerce committee.

- I-2113 would end another mistake made by the majority in 2021 – the criminal-friendly restrictions put on vehicular pursuits by law enforcement. I realize pursuits can be risky, but I also know our officers are trained to minimize that risk. It’s no wonder auto thefts and other property crimes have jumped in our state since criminals learned they would no longer be pursued. I-2117 has been referred to our Law and Justice committee.

- I-2117 would basically repeal the cap-and-trade law that has made gas in Washington far more expensive than in Oregon and Idaho. In doing so it would also settle the fuel-surcharge issue hurting our agricultural and maritime sectors, which neither the majority nor the Inslee administration has done. If cap-and-trade (officially, the “Climate Commitment Act”) goes away, then there’s no more promise of fairness for the state Department of Ecology to break. This has been referred to the Environment, Energy and Technology committee.

- I-2081 would essentially create a bill of rights for parents who want more information about what their children are doing at school. It’s similar to but more detailed than the parental-rights proposal I’ve offered every session since becoming senator. As this initiative has been referred to the Senate committee on education, on which I serve, I have asked the chair to have a public hearing on the measure. Click here for the details.

As these initiatives will help lower the cost of living, make Washington safer and make our school system better, I intend to support them. That will either happen in the Senate or at the November general election.

What voting ‘without recommendation’ really means

A lot of rules govern our handling of legislation, and some of the words that go along with the process aren’t as clear as they could be. I was reminded of that recently in relation to a bill that has roots in our part of the state.

The Senate State Government and Elections Committee is one of my committees. On day two of this session the chair had us take public testimony on SB 5824, which has to do with changing the chapter of state law about public library districts.

SB 5824 stems from the effort this past year to dissolve the Columbia County Rural Library District, which became a ballot measure that ended up being blocked by a court from the November ballot. The bill was introduced by the committee chair, a senator from Olympia, at the request of the secretary of state, who is Washington’s chief elections officer.

It’s important to note the committee chair sets the agenda for her or his committee, meaning which bills receive hearings, which are brought up for votes, and when that happens. The chair scheduled SB 5824 for “executive action” three days after the public hearing.

When a committee takes executive action on a bill, members may choose between a “do pass” or “do not pass” recommendation or a third option, which is to vote “without recommendation” – essentially, a neutral vote that doesn’t hinder the bill’s progress.

After the hearing on SB 5824, I had questions about the scope of the change it would make, plus this: Legislation passed in 1947 made it so a rural county library district could be established or dissolved through a petition signed by 10% of the voters within that district. In the form in which it came before our committee, SB 5824 would have replaced 10% with 35% but only for the dissolution of such a district. Does it seem consistent or fair to you that dissolving a taxing district should be more than three times as difficult than creating one?

If a law needs to be clarified or updated, I am willing to listen. In this case I just wasn’t going to recommend for or against the bill’s passage by the full Senate without knowing more.

Because I could not get answers ahead of the committee vote, I chose to refer the bill “without recommendation.” While that was reported accurately here in the Walla Walla Union-Bulletin, some people inaccurately concluded I had opposed the bill. Once I explained how we vote in committee, and why I voted as I did on SB 5824, they understood.

When SB 5824 came before the full Senate this past week, the Republican leader on the state-government committee offered an amendment that would set the threshold for dissolving a library district at 25% — still far above what the law now requires but a compromise from 35%. The amendment was accepted, and the bill passed unanimously.

If you have a question about any vote I cast, by all means call or write. I want my constituents to have the facts.

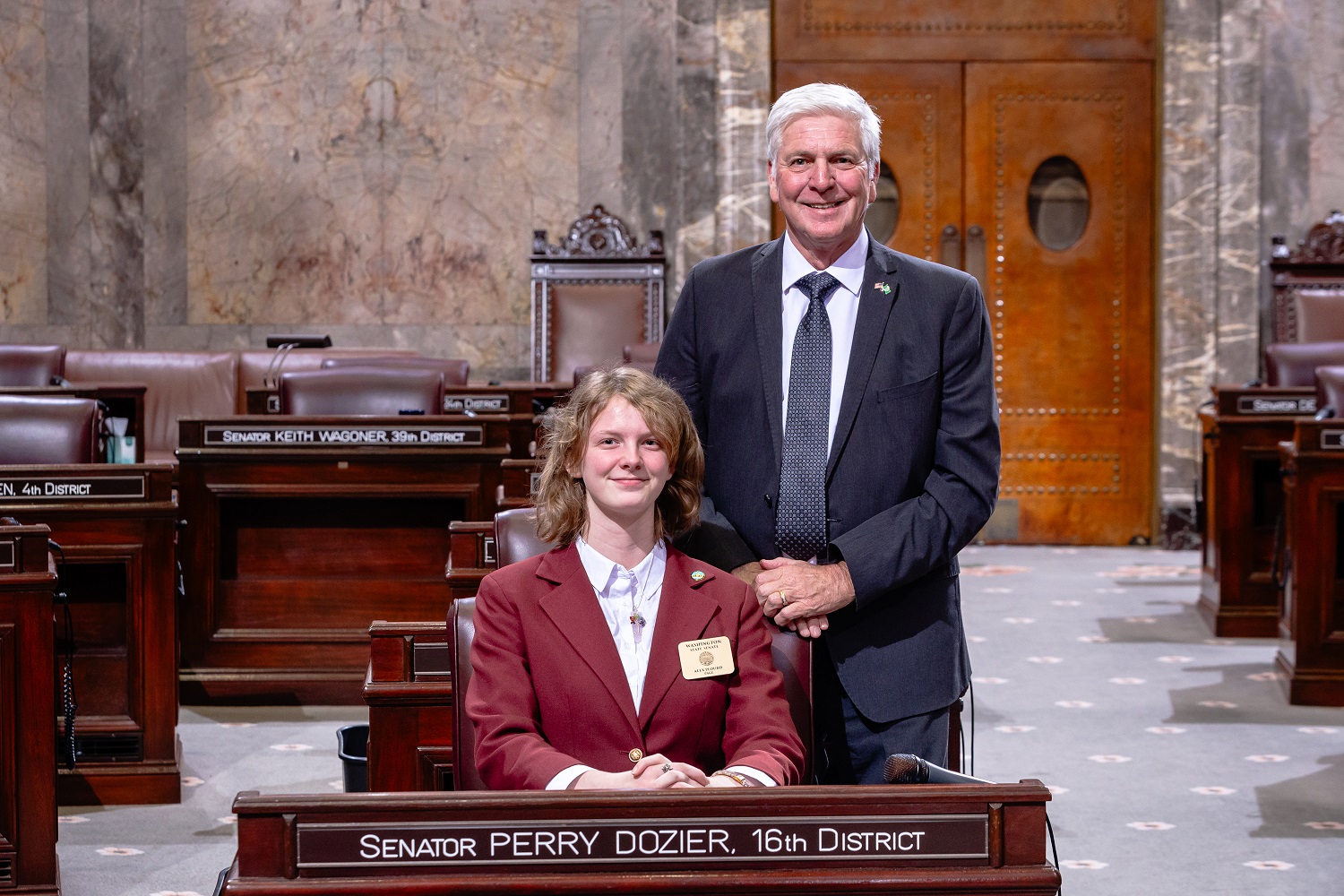

The first student I sponsored as a Senate page this session was Alex Plourd, an 8th-grader at Highlands Middle School in Kennewick. Alex is the daughter of Brenden and Shauna Plourd of Kennewick. She did a wonderful job this past week, and was here when the Senate passed some important legislation!

***

I am working to make living in our state more affordable, make our communities safer, uphold our paramount duty to provide for schools, and hold state government accountable. I’ll work with anyone who shares those goals and wants to find solutions.

Please reach out to my office with your thoughts, ideas and concerns on matters of importance to you. If you don’t already, also consider following me on Facebook. I am here to serve and look forward to hearing from you.

Sincerely,

Perry Dozier

State Senator

16th Legislative District