I was happy to welcome members of Teamsters 117, which represents Department of Corrections employees, when they came over from Walla Walla to visit the Capitol earlier this month. In response to the question “Who has been assaulted on the job?” probably half raised their hands. Feedback like this often inspires legislation, and I will be following up with them on this and other concerns in the spring.

Dear Neighbor,

Greetings from the state Capitol!

This week the state Senate wrapped up its work on bills introduced by senators, with the exception of updates to the three state budgets. The “cutoff” for approving Senate bills arrived at the end of Tuesday; we then went back to meeting as committees to take up the House legislation passed over to us (and the House committees are doing the same with Senate legislation).

The six voter initiatives submitted to the Legislature this session continue to get attention one way or the other. I and other Republicans have called for public hearings on these measures, in line with a requirement in our state constitution; the majority Democrats finally made commitments about three this past week. I’d like to know what you think about how the Legislature should handle these, and invite you to take a quick online survey. Details are below.

Dozier bills move to House for consideration

Early this week the state Senate unanimously passed my Senate Bill 6238, to update a property-tax exemption that benefits the widows and widowers of honorably discharged veterans. It was created in 2005 but has not kept pace with similar exemptions since then. SB 6238 was referred to the House Finance Committee for consideration; being a fiscal committee, it has until Feb. 26 to move my bill forward.

Also getting unanimous approval was SB 5801, a bill that has to do with the banking industry. I introduced it at the request of our state’s Uniform Law Commission, and the bill is a good example of just how narrowly focused and non-partisan a piece of legislation can be. That’s probably why it is moving so quickly through the House, with a public hearing Wednesday and a “yes” vote from the House Committee on Consumer Protection and Business yesterday morning, well ahead of next Wednesday’s deadline for policy committees to act on legislation.

Property-tax proposal pulled due to public pressure

Sometimes it’s more important to keep a bad piece of legislation from becoming law, which is why I’m happy about the demise of SB 5770. It would have opened the door to tripling the growth of local property taxes…without voter approval!

Since 2001, and the passage of Initiative 747, the annual growth rate of property taxes has been limited to 1% annually, unless voters agree to a larger increase. This shouldn’t be a partisan issue, as that cap was confirmed in 2007 by a Democratic-controlled Legislature at the request of a Democratic governor.

Still, a group of Democrats from Puget Sound pushed SB 5770 through the Senate Ways and Means Committee and onto the Senate voting calendar. That’s when the public rose up in protest, and we held a news conference that resulted in a lot of media attention. The prime sponsor of the bill then announced he would stop trying to get it through the Senate, which was the right decision – but the excuses he gave in this news report are concerning.

One is that “supporters need to work on better explaining the needs of cities and counties…and helping the public better understand the mechanics of property taxes.” Having been a county commissioner for eight years, I have a good sense of what local governments need, versus what they might want. Also, to be clear, the 1% cap has never prevented local governments from asking voters for more than 1%. If a majority of voters in King County (where the prime sponsor is from) approve a 10% increase in their property taxes, for whatever purpose, they are free to tax themselves more.

I wonder if the supporters of this property-tax proposal understand the “mechanics” families must go through to contend with all the costs being layered upon them in recent years, through a variety of government policy decisions. A great example is the cap-and-trade law that was passed in 2021 and took full effect in 2023, which has raised the cost of just about everything, starting with gas at the pump and natural-gas heat (which the majority is now trying to ban through HB 1589, which was passed by a Senate committee yesterday). Don’t get me started on what cap-and-trade means for our agricultural sector, and how promises made in the cap-and-trade law aren’t being honored by Governor Inslee’s administration.

The real purpose of SB 5770 is to allow a higher annual increase in the tax rate without going to the voters. That sounds like the opposite of “democracy” to me. Besides, the housing shortage in our region and our state as a whole is challenging enough without allowing tax hikes that would hit not just property owners but also renters.

I was pleased that none of the counties I serve in the 16th District came to me asking for this bill. They realize they can ask their voters to go above the 1% limit, and I appreciate that our area commissioners are living within the means provided by the taxpayers, even if it makes budgeting more challenging.

I’m glad the proposal has been dropped for this year, but unfortunately, we should expect to see it again.

Proposed hospital-merger restrictions could be very harmful to rural Washington

With the majority’s proposed property-tax increase off the table, Senate Bill 5241 becomes the worst bill of the session so far – at least from the Senate side.

This bill has the meaningless title of “Concerning material changes to the operations and governance structure of participants in the health care marketplace.” That offers no clue about the true effect SB 5241 would have on our state. An accurate title would be something like “Allows a partisan state official to decide whether a hospital closes.” The trouble is, being that clear would alarm people across our state and keep this misguided proposal from flying under the radar.

The prime sponsor claims this is about preserving access to affordable health care, but as they say, the devil is in the details – she also acknowledges the intent is to ensure hospital mergers and acquisitions specifically don’t restrict access to “end-of-life, reproductive and gender-affirming care.”

Let’s suppose a small rural hospital is at risk of closing, and its only chance to continue operating is to be acquired by a larger hospital with a religious affiliation. SB 5241 would give the attorney general’s office the power to determine – over a 10-year oversight period – if such a transaction would affect access to end-of-life (assisted suicide), reproductive (including abortion) and gender-affirming care, which is defined in detail in the bill. That’s a very long time for a rural community to have a sword hanging over the head of its nearest health-care facility, should a merger be the only way to keep it open.

The version of the bill brought to the floor of the Senate was a 27-page rewrite that was made available for review only that day, while we were in the middle of debating and voting on a long list of other bills. I stood up during the 3-hour debate on SB 5241 and explained, using a recent trip to the Dayton General Hospital emergency department as an example, the danger this approach presents to health-care access in our area. It’s as though the supporters of this bill would rather see hospitals close than to have them remain open under an agreement that somehow involves religious affiliations.

SB 5241 is part of an agenda, which is why Republican amendments meant to protect consumers, involve the secretary of health, etc., were rejected, and why the bill is whizzing through the House – a vote in the House Civil Rights and Judiciary Committee is scheduled Tuesday. Doesn’t it seem odd that a “health care marketplace” bill isn’t coming before a health-care committee in either chamber?

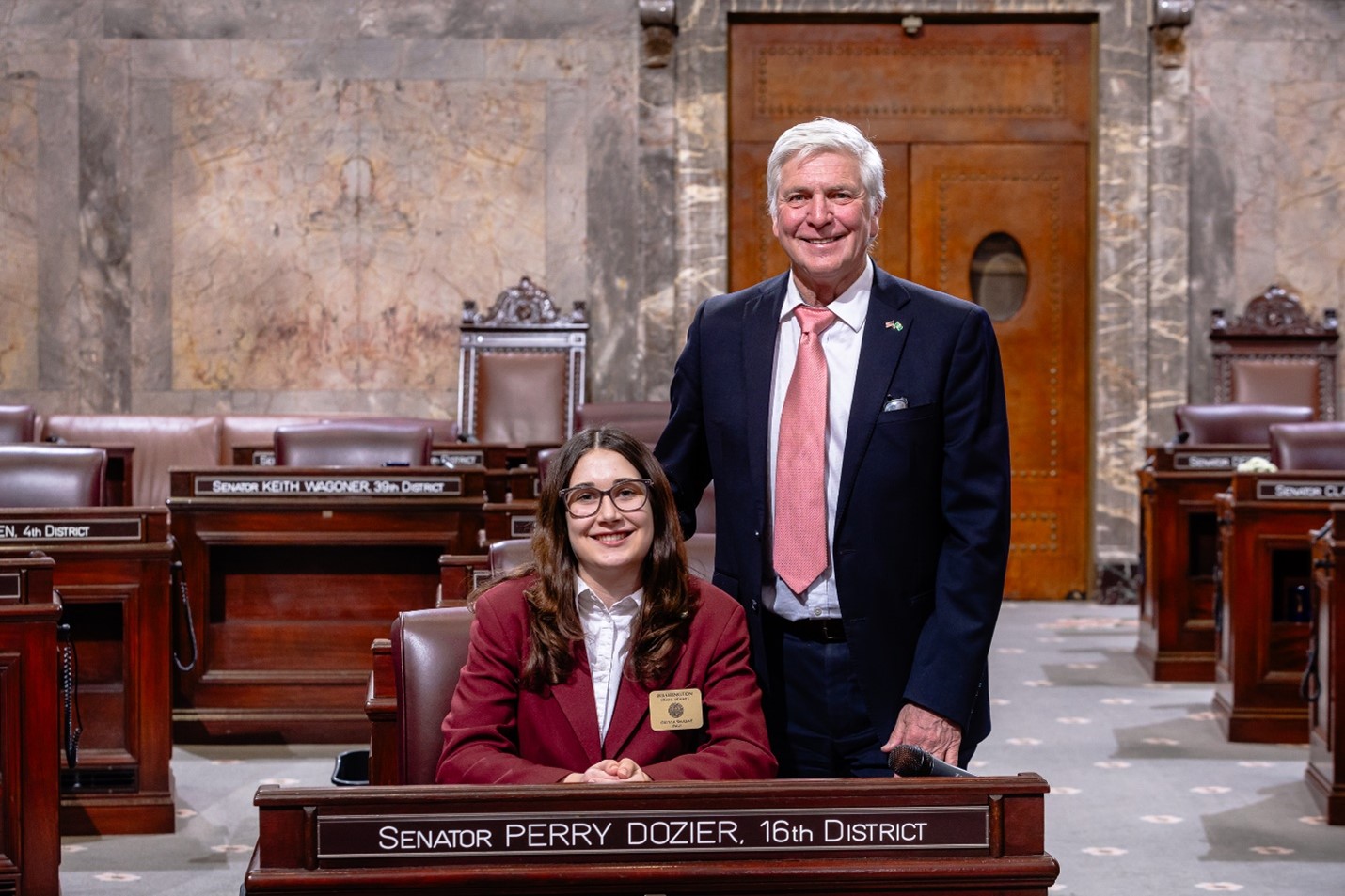

It was my privilege to sponsor Olivia Smasne as a Senate page this past week. She’s a 9th-grader at Prosser High and is the daughter of Brent and Jamie Smasne of Prosser. I know Olivia appreciated being able to see a side of the Senate and the lawmaking process that isn’t shown on the TVW network, and she was here at one of the most important times of any session. Thanks, Olivia!

Democrats agree to committee hearings on only three initiatives, despite constitutional requirement

Article II, Section I of Washington’s constitution is clear about how legislators should treat initiatives submitted to them: “Such initiative measures, whether certified or provisionally certified, shall take precedence over all other measures in the legislature except appropriation bills and shall be either enacted or rejected without change or amendment by the legislature before the end of such regular session.”

That part about “take precedence” means we are supposed to consider the initiatives ahead of every other bill except spending bills (like the budgets). Yet here we are, two-thirds of the way through the session, and only now is the majority side responding.

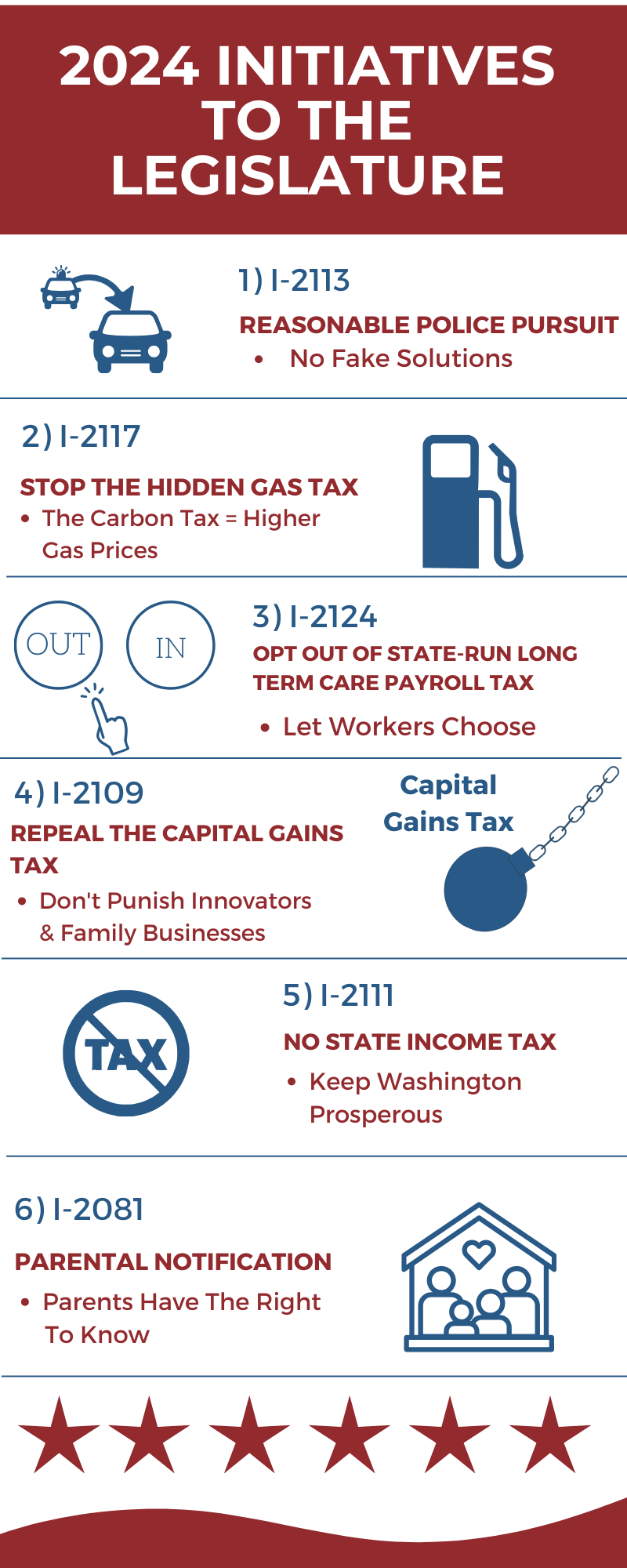

Yesterday afternoon the top Democrats in the Senate and House announced there will be joint Senate/House hearings week after next on three initiatives: I-2113 (police pursuits), I-2111 (income-tax ban) and I-2081 (which would create a parental bill of rights concerning , similar to legislation I’ve introduced each of the past three years).

They confirmed there will not be hearings on I-2117, which would repeal the cap-and-trade law that is driving up everyone’s gasoline and natural-gas costs; I-2109, which would repeal the tax on income from capital gains, and I-2124, which would end the mandatory payroll tax tied to the state-run long-term care program.

The chair of the Senate Labor and Commerce Committee announced this past week that she intends to hold a work session on I-2124, but that is not the same as a hearing because the public is not allowed to testify.

I have no question the Democrats’ decision to have any hearings is due to the pressure Republicans have been applying all session long, but still, the bottom line is that they’ll let the people be heard on only half of the six initiatives.

I want to hear from you about all of them, however. Please take a few minutes to click on the link or the QR code and complete my survey!

|

Take my online survey about the six voter initiatives

|

***

I am working to make living in our state more affordable, make our communities safer, uphold our paramount duty to provide for schools, and hold state government accountable. I’ll work with anyone who shares those goals and wants to find solutions.

Please reach out to my office with your thoughts, ideas and concerns on matters of importance to you. If you don’t already, also consider following me on Facebook. I am here to serve and look forward to hearing from you.

Sincerely,