Dear Neighbor,

Late in a legislative session, the priorities of the majority come into focus. Judging from the two major policy bills that were passed Thursday and Friday by the Senate’s majority Democrats, the priorities can be summed up in a word: control.

Let’s go in reverse order. On Friday afternoon, the big discussion was about parental control — specifically, a second effort by Democrats to undermine the parents’ bill of rights established in 2024’s Initiative 2081.

I have a special affinity for the parents’ bill of rights because during each of my first three years as a senator, I introduced legislation to create something very similar. It wasn’t necessary to do so in 2024 because by then, I-2081 was being certified and submitted to the Legislature.

Democrats joined us to unanimously support I-2081 in the Senate more than a year ago, yet there they were on Feb. 5 approving a first piece of anti-parent legislation, Senate Bill 5181. It’s now one step from a vote by the full House.

The bill that came before the Senate on Friday was House Bill 1296. It’s similar to SB 5181 but worse in its own way. A committee amendment would basically allow the state to withhold 20% of a school district’s funding for “willful noncompliance” with state education laws.

To me this creates a serious problem because districts have to follow federal education laws (like the Family Educational Rights and Privacy Act of 1974) as well as state laws. Should those laws conflict, school-board members could easily find themselves having to choose whether the district should comply with federal law or state law, knowing the state can inflict a financial penalty if its law isn’t followed.

It seems completely backwards, to put it diplomatically, for Democrats to threaten the withholding of school funding. After all, the state’s paramount duty is to provide for K-12 education, and our districts need more support than they’re getting for things like special education.

Because the Senate made changes to this anti-parent bill, it needs to go back to the House for what’s called “concurrence.” If the House concurs, or agrees, with the Senate’s changes, the bill will head to the governor’s desk. If not, HB 1296 could come back to the Senate.

There’s no telling how this story will play out over the next couple of weeks. But it should already be clear to the parents of our state where the majority’s priorities lie — and it’s not with parents.

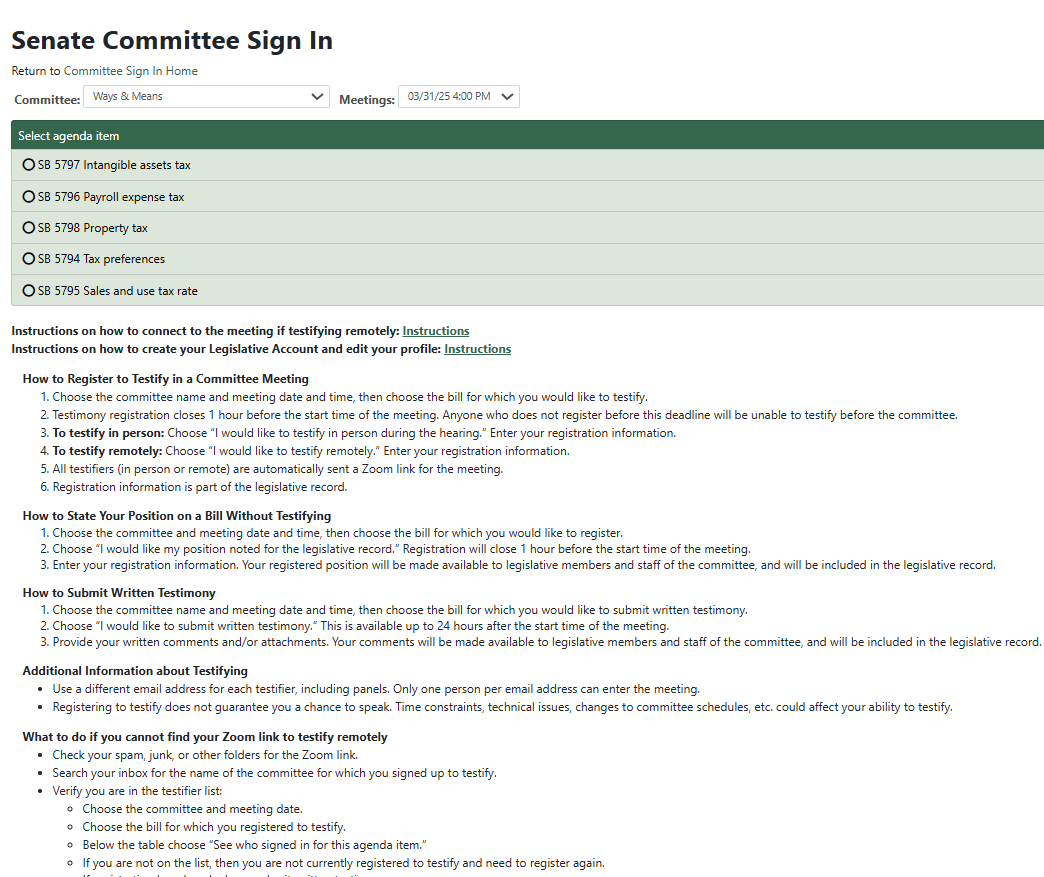

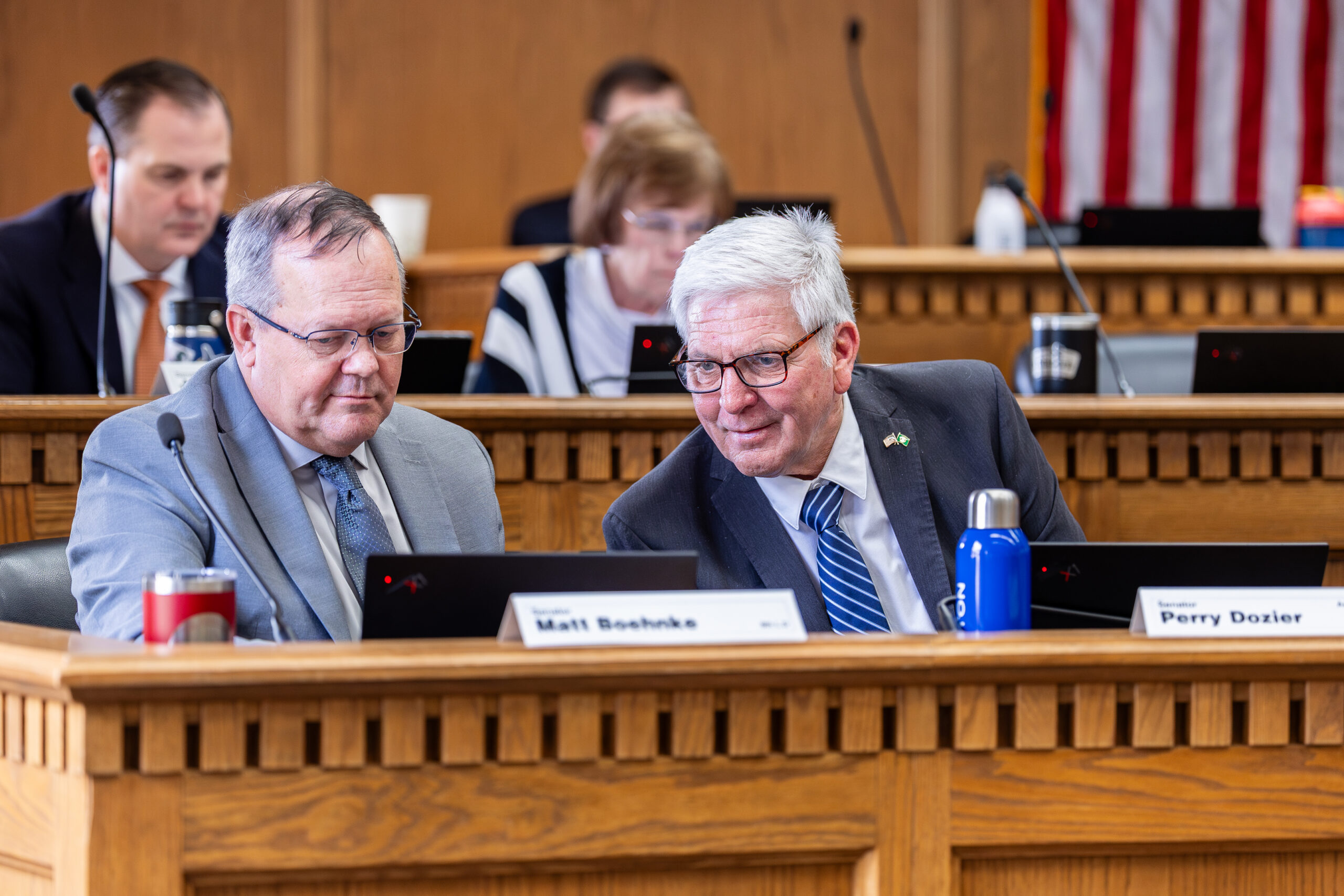

The property-tax increases being pushed by Democrats (Senate Bill 5798 and House Bill 2049) are among the worst bills of the session. I’m particularly concerned about how higher property taxes could hurt senior-age Washingtonians — click here for my take on that. To keep these proposals from flying below the radar, we invited members of the public to join us for a news conference focused on property taxes (several of them are in front of me in the photo above). I encourage you to watch our news conference by clicking this link.

Rent control won’t increase supply of rental housing

On Thursday afternoon, the major debate in the Senate chamber had to do with rent control — or to put it more accurately, government-imposed price controls on rental housing.

I know the people of our legislative district are concerned about the lack of affordable housing, because it was the number-one topic at our mid-March town-hall meeting. Some of those participating expressed support for rent control, and the appeal is understandable — especially for someone who is now renting.

But as a policymaker, I also think about the renters of tomorrow, and those who choose to become housing providers. And even if my degree was in something other than economics, I’d still know from my farming experience what happens when demand for a commodity exceeds the supply of that commodity. Prices go up!

The best way to bring housing prices down, especially over the long term, also applies to rental housing: increase the supply.

For reasons that aren’t completely clear, our Democratic colleagues seem to think price controls need to be part of the answer. A month ago House Democrats approved the latest example of rent-control legislation — House Bill 1217. That’s the bill which came before the Senate on Thursday.

As passed by the House majority, the bill would put a 7% cap on annual rent increases. When it came off the Senate floor, the cap had been raised to 10%, plus the consumer price index, through an amendment.

I don’t know anyone who would get into or stay in the housing business with a 7% limit on annual rent increases. That could easily cause a housing provider to lose money, when the idea of such an investment is to do better than break even.

Going to the higher 10% limit makes this bad bill “less bad,” to use an Olympia expression. So does the passage of another amendment that exempts family- or individually-owned single-family homes from the law. Still, only Democrats voted for the bill, because price controls go completely against the free-market approach preferred by Republicans.

If Democrats also go ahead with property-tax hikes, it will only add to the squeeze on housing providers. They’ll have more reason to get out of the market, reducing the supply of rentals.

As with the anti-parent bill passed on Friday, HB 1217 must go back to the House for concurrence with the changes made in the Senate. We may not know the fate of this bill until the very last day of the session, which is April 27.

***

I am working to make living in our state more affordable, make our communities safer, uphold our paramount duty to provide for schools, and hold state government accountable. I’ll work with anyone who shares those goals and wants to find solutions.

Please reach out to my office with your thoughts, ideas and concerns on matters of importance to you. I am here to serve and look forward to hearing from you.

Sincerely,

Perry Dozier

State Senator

16th Legislative District

This past week I had the pleasure of spending a few minutes with a group from the Girl Scouts of Eastern Washington and Northern Idaho. There were so many visitors that we brought them into the Senate Republican caucus room, which is where we meet to go over bills and amendments before the debates and voting in the Senate chamber.

This past week I had the pleasure of spending a few minutes with a group from the Girl Scouts of Eastern Washington and Northern Idaho. There were so many visitors that we brought them into the Senate Republican caucus room, which is where we meet to go over bills and amendments before the debates and voting in the Senate chamber.