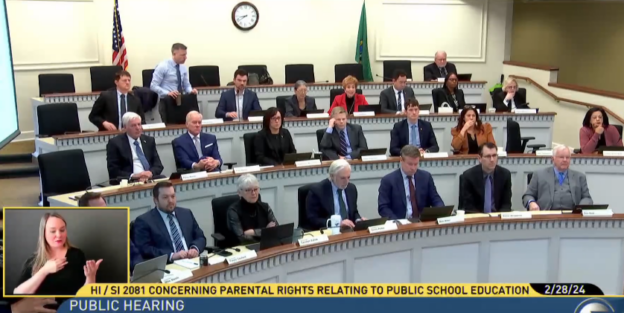

I don’t believe unemployment benefits are meant to be paid to people who walk off the job and go on strike, yet on Friday the majority Democrats on the Senate budget committee endorsed a bill to allow that. To view the public hearing that led to the vote on SB 5041, click here.

Dear Neighbor,

When I was appointed to the Senate Ways and Means Committee ahead of this legislative session, I figured it would keep me busier than any of my other committees. This week, “busier” was an understatement. Wow!

To make a long story short, bills that have a cost associated with them need to go before a budget committee after coming out of a Senate policy committee – and except for bills related to transportation, they all come to our Ways and Means committee.

As a result, Monday’s committee agenda had public hearings for 27 bills, Tuesday brought hearings on 21 more. There were 31 hearings on the Wednesday agenda, and on Thursday… we began voting. That list had 58 bills, and yesterday’s voting list had 49.

This is on top of the hours spent in the Senate chamber this week, debating and voting on bills that had cleared the necessary committee hurdles.

Does our state need all 107 of the bills we saw Thursday and Friday to become law? Absolutely not. A good example is SB 5041, which would provide taxpayer-funded unemployment benefits for striking workers.

If you get laid off, you can apply for unemployment benefits – but not if you quit. The same logic applies to going out on strike. It’s still a case of voluntary separation.

Striking workers would have less financial incentive to stay at or return to the bargaining table if they’re allowed to collect unemployment benefits. That would give them a distinct advantage over the employer, which explains why SB 5041 is a high priority for our state’s labor organizations. But it hardly seems like a good use of taxpayer dollars.

I’m not on the Senate labor committee, so if it wasn’t for my seat on Ways and Means, I wouldn’t be able to ask questions that help expose the flaws in this bill, as I did during the public hearing on it Wednesday.

Here’s a sampling of some other bills that came before the Ways and Means committee this week:

- SJR 8200: Amends the state constitution to allow increases in property taxes through school bonds by removing the 60% vote needed and lowering it to a simple majority (94% “con” testimony in committee)

- SB 5626: Provides unemployment benefits for undocumented workers in a way that easily allows fraud

- SB 5179: Allows the state school superintendent to go after schools/officials if they don’t comply with legislative mandates

- SB 5266: For those sentenced as juveniles, eliminates the 20-year waiting period to petition for release – even if convicted of violent crimes

- SB 5382: The “initiative killer” bill, which includes threatening signature gatherers for initiatives with fines and jail time if certain requirements aren’t met, and preventing people who don’t have addresses or who use post-office boxes from signing initiative petitions

With the close of business Friday, the Senate’s two budget committees (Transportation is the other one) joined the policy committees that are already on break.

Starting Monday the activity in the Senate will move full-time to the Senate chamber through March 12. During that time you’ll find Republican and Democratic senators doing one of two things: meeting in their respective caucuses to discuss bills, and amendments to those bills, or out on the “floor” debating and voting on those bills and amendments.

From the Mailbag: Keeping tax dollars local?

Earlier in this session I shared part of an email that came from a constituent in Richland, who was expressing her concerns about actions being taken at the federal level. Today let me share an excerpt from an email sent by a Walla Walla constituent, which is about the relationship between the state and its many municipalities.

“Your newsletter spends much of its digital ink attacking Democrats, as is usual for Republicans who seem to have few ideas other than ‘lower taxes.’ How about favoring some kind of bill allowing local areas to keep more of their tax money rather than sending it to the state? I’ve long advocated that each county in the state be forced to pay its own way.

“That would mean, of course, that Walla Walla County, where I live, could take in no more in state spending than it collects in taxes. This could be regulated over a three year period to account for large projects. Allowing locals to collect and spend their own money is an intensely Republican idea, i.e. devolving government to its most local level.”

He’s right, Republicans do prefer local control because it means decisions are made closer to the people they affect. That’s why we typically oppose legislation that dictates school-related policies from Olympia in a way that overrides the authority of local school boards.

But to get to this constituent’s point: In 2022 I co-sponsored a bill to assist with the hiring of law-enforcement officers. It would have basically allowed cities and counties to collect and spend 1/10th of 1 percent of the sales tax that would normally have gone to Olympia. The bill didn’t even make it out of the Senate Ways and Means Committee.

Maybe my Democratic colleagues were opposed to letting the locals keep some tax dollars. Perhaps they were opposed to helping communities rebuild their law-enforcement agencies after the exodus of officers we saw in the 2020-21 timeframe. I have no way of knowing. But there’s an example of how I tried to keep more tax money at home, and it didn’t work.

By the way, the bill’s Republican sponsor reworked it so the funding source became grants from the state budget rather than tax credits. His perseverance seems to have paid off, because Governor Ferguson publicly endorsed the bill in his inaugural address. SB 5060 was passed by the Ways and Means Committee Thursday!

As for “attacking” Democrats – like a baseball umpire, I call ‘em as I see ‘em. If my experience tells me legislation introduced by a Democrat is bad policy, either for our district or state, it should be OK for me to let my constituents know.

Republicans don’t have a corner on good ideas, which is why I’ve co-sponsored a couple dozen bills this session that were filed by my Democratic colleagues. I also welcome ideas from constituents, like this one from Walla Walla. But to be clear, “lower taxes” are always a worthwhile goal, in my book.

|

***

I am working to make living in our state more affordable, make our communities safer, uphold our paramount duty to provide for schools, and hold state government accountable. I’ll work with anyone who shares those goals and wants to find solutions.

My priorities (shared by Senate Republicans) are:

Here’s how to:

- Follow the bills I am sponsoring.

- Find out how to testify in committee hearings on bills that are before the Legislature.

Please reach out to my office with your thoughts, ideas and concerns on matters of importance to you. I am here to serve and look forward to hearing from you.

Sincerely,

Perry Dozier

State Senator

16th Legislative District

EMAIL: Perry.Dozier@leg.wa.gov

OLYMPIA PHONE: (360) 786-7630

OLYMPIA OFFICE: 342 Irving R. Newhouse Building

MAILING ADDRESS: P.O. Box 40416, Olympia, WA 98504