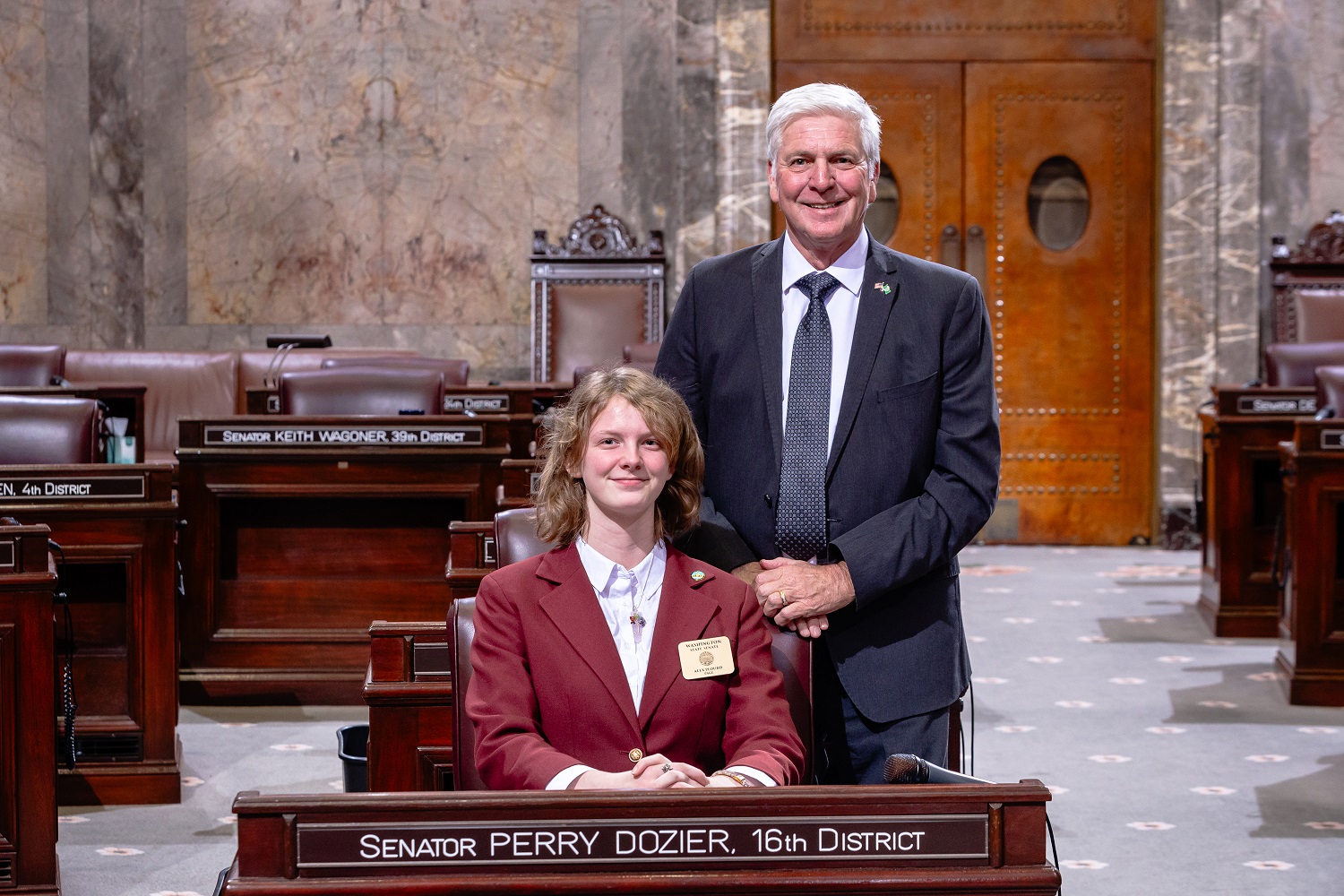

With Sen. Lynda Wilson of Vancouver in the Senate chamber. The supplemental operating budget passed today by the state Senate reflects some of my input, which I worked through her as Senate Republican budget leader and her counterparts on the majority side. Keep reading for details.

Dear Neighbor,

Greetings from the state Capitol! I have important news about voter initiatives that couldn’t wait… for reasons that will become apparent.

This past weekend I reported to you how our Democrat colleagues had finally committed to holding public hearings for three of the six initiatives submitted to us by the people. Now we have a schedule for those hearings, and opportunities for you to participate.

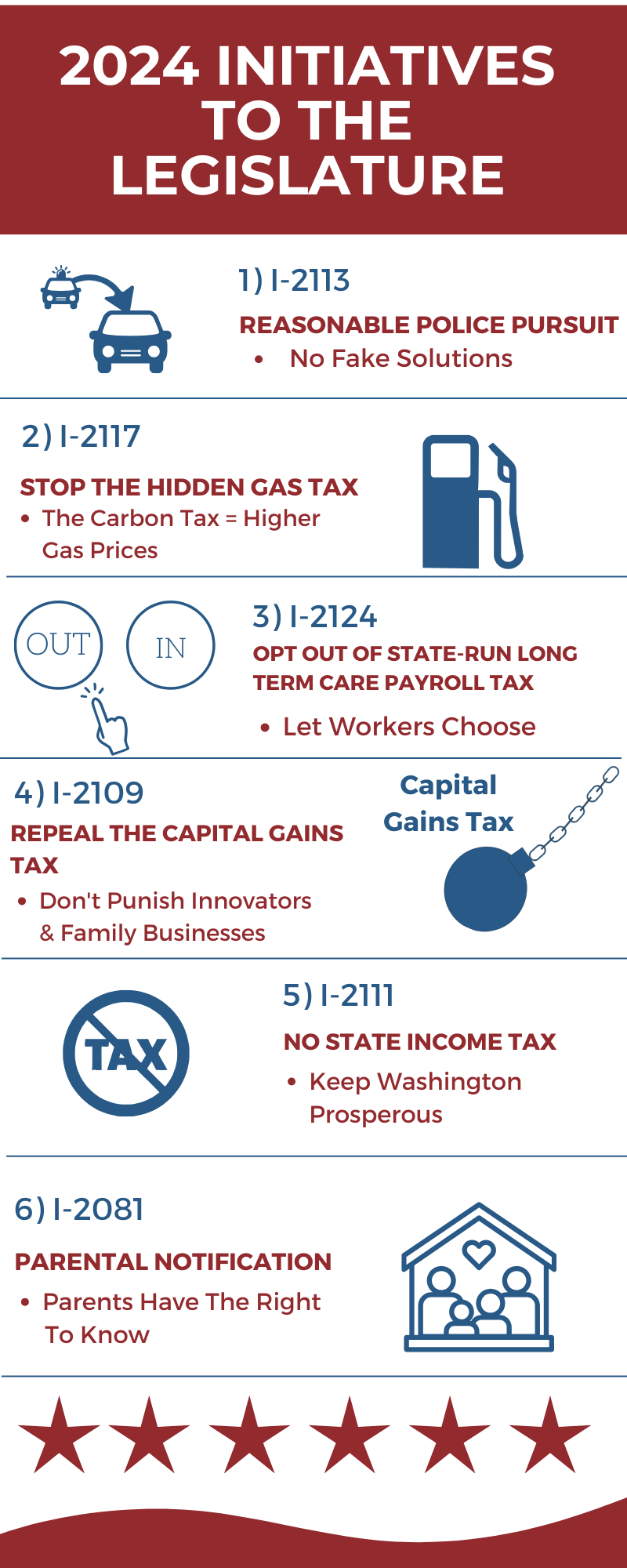

The three measures to be considered are Initiative 2111 (total ban on income taxes in our state), Initiative 2113 (restore the ability of police to conduct vehicle pursuits) and Initiative 2081 (parental rights regarding their children’s education).

I-2081 builds on the parents’ bill of rights legislation I have sponsored since 2021. It will come before the Senate Early Learning and K-12 Education Committee, on which I serve, and I am working with others on the committee to make sure the hearing covers the most important aspects during the one hour (!) allotted.

Unfortunately, the majority is still refusing to hold hearings on the initiatives to repeal laws that are about taking money and giving it to the state: I-2117, I-2109 and I-2124. Washington’s constitution does not say to give precedence to half the initiatives and ignore the rest. The people are the sponsors of these initiatives, and they deserve to be heard on all six!

To support the initiatives next week sign in as PRO, using the links below. Be sure the button next to the initiative number under “select agenda item” is checked, to display your options — which include submitting written testimony or testifying “live” in person or remotely:

- Click here to sign in about Initiative 2111 (ban on income taxes): public hearing begins at 12:30 p.m. Tuesday, Feb. 27, in the Senate Ways and Means Committee. As a member of this committee I will be in a position to ask questions.

- Click here to sign in about Initiative 2081 (parental rights): public hearing begins at 8 a.m. Wednesday, Feb. 28, in the Senate Early Learning & K-12 Committee.

- Click here to sign in about Initiative 2113 (police pursuits): public hearing begins at 9 a.m. Wednesday, Feb. 28, in the Senate Law & Justice Committee. I’m also a member of this committee and am looking forward to hearing the people!

For more detail about the six initiatives click here. I want to hear from you about all of them. Please take a few minutes to click on the link or the QR code and complete my survey!

|

|

Take my online survey about the six voter initiatives submitted to the Legislature this session!Scan the QR code or click here to begin |

|

|

Local projects supported in budgets adopted, proposed this week

State government runs on a two-year budget cycle, with new budgets developed and adopted in odd-numbered years. This is why we alternate between 105-day sessions and 60-day sessions; in this year’s “short” session we are reopening the budgets approved in 2023 to make adjustments that are intended to carry through the remainder of the budget cycle (until June 2025). Those changes are captured in “supplemental” budgets.

This week the Senate adopted supplemental versions of the 2023-25 operating budget and capital budget. A high-level summary of the supplemental operating budget is here; before the final vote I worked with the budget leaders from both parties to make two adjustments of interest to our area.

One adds a $501,000 appropriation to help with the cleanup of gasoline contamination in downtown Walla Walla; the second creates a fourth tier in an agricultural-fuel reimbursement I discovered in the budget after it became public Monday. For those who purchase 10,000 gallons or more of farm diesel annually, the payment would go to $4,500, up from $3,400 (which remains the third-tier payment).

While I appreciate the majority’s support for my amendment, this approach still does not — as I stated publicly this week — truly reimburse those stuck paying a surcharge on farm fuel due to the state’s cap-and-trade law. The best solution is to do away with cap-and-trade completely, which is the purpose of Initiative 2117. It will save money for anyone who buys any kind of motor fuel or uses natural gas for any purpose, residential or commercial.

The capital budget adopted by the Senate appropriates another $6.6 million toward projects in our 16th Legislative District. I’m happy that includes another $1.5 million for the Columbia Valley Center for Recovery (it’s still listed as Three Rivers Behavioral Health Center, as the name changed after the underlying budget was adopted in 2023). Even better, in its way, is the $300,000 for a trio of local projects: resurfacing and revitalizing the public swimming pool in Prescott, funding a childcare center for Waitsburg and support for the Prosser Clubhouse, run by the Boys and Girls Clubs of Benton and Franklin counties.

From here, the leaders for the operating and capital budgets from the Senate and House will get together and hammer out the differences between their respective spending plans, then come back with a compromise for another vote.

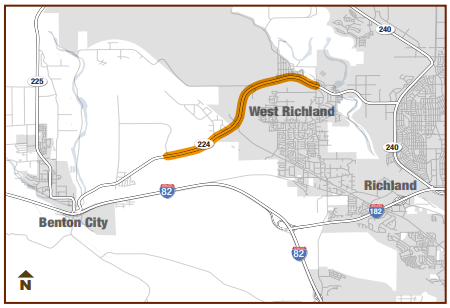

I also have an important appropriation in the Senate’s proposed supplemental transportation budget, for the State Route 224/Red Mountain project in the Benton County part of our district. Click here for my news release on it, from earlier this week. That budget will come up for a vote from the full Senate this next week, then it will go through the same compromise process.

***

I am working to make living in our state more affordable, make our communities safer, uphold our paramount duty to provide for schools, and hold state government accountable. I’ll work with anyone who shares those goals and wants to find solutions.

Please reach out to my office with your thoughts, ideas and concerns on matters of importance to you. If you don’t already, also consider following me on Facebook. I am here to serve and look forward to hearing from you.

Sincerely,