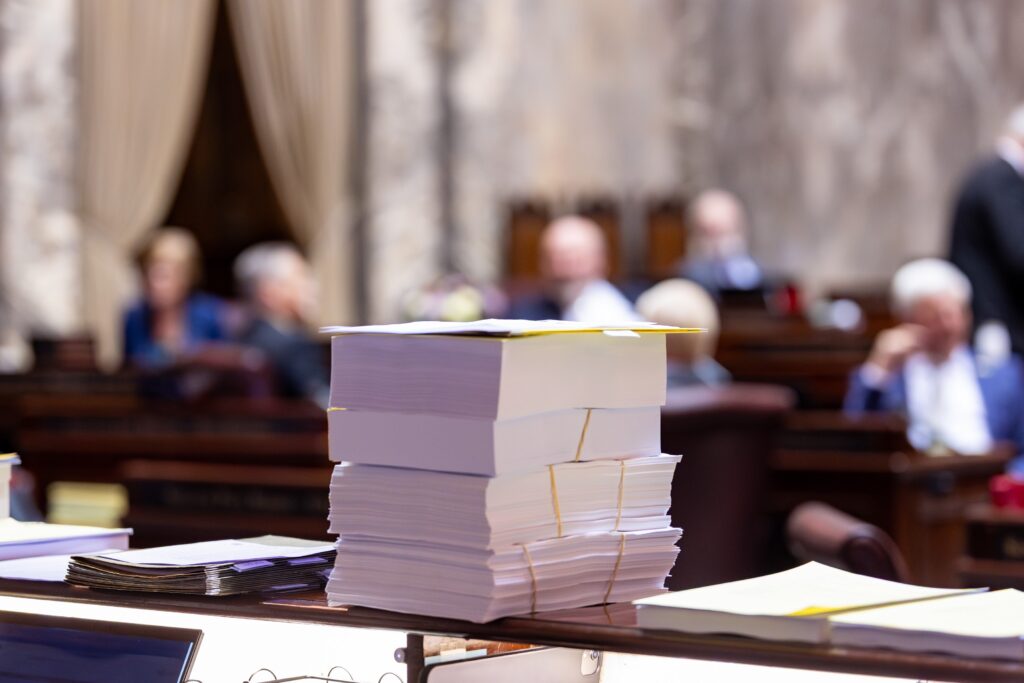

It’s normal for the new state budgets to be adopted on the final day of our regular legislative session, and this year was no different. This is how the operating budget looked as it sat on the “bar” at the front of the Senate chamber on Sunday. The stack contains the budget adopted by the Senate on March 29, the version approved by the House on March 31 and the compromise between the two chambers, which few people saw until Saturday morning — which is a concern all by itself.

Dear Neighbor,

It was a very challenging legislative session that wrapped up this past Sunday, on schedule. The session felt longer than 105 days because of all the time we spent opposing the bad policies and harmful decisions the Democrat majority seemed determined to bring before us.

As we came into this session back on January 13, we knew that we were facing a multibillion-dollar budget shortfall and that the majority would use this as an opportunity to go on a tax-raising spree. Their first attempt at an operating-budget proposal did just that – it would have increased taxes in our state by $21 billion!

The Democrats’ agenda also continued to lean away from freedom and the free market with controversial legislation that would undermine your rights as a parent, cripple small business, worsen the education gap and limit your Second Amendment rights.

It didn’t have to be this way

We could have had a budget with zero new taxes. That’s right: the operating budget Senate Republicans proposed (Senate Bill 5810) proved we could have funded the priorities Washingtonians share — with no new taxes or fees and no cuts to services!

No one should be fooled by claims that higher taxes were inevitable because of the state’s budget shortfall. To be clear, the shortfall was never as large as Democrats claimed it was; we heard $12 billion, $15 billion, even $18 billion, but according to our non-partisan budget staff — people who don’t have a political agenda – it topped out at about $7.5 billion. That’s a lot less than the size of the Democrats’ tax package. What was clearly evident is this shortfall was the result of the majority’s reckless and uncontrolled overspending for too many years.

On Sunday, only Democrats voted for their budget. Republicans wouldn’t pile all those taxes and fees on the people of our state.

Defending the people we serve

Our no-new-taxes ‘$ave Washington” budget is an example of how Republicans offered ideas that are better for our state but don’t have the votes to get them all to the governor’s desk. For that reason, our victories this session were more about the bad legislation we derailed so it wouldn’t have lasting effects on the people we serve.

The following is a list of just some of the positive things we accomplished:

Public safety

- Created a grant program to help law enforcement agencies hire more officers; a bill I’ve sponsored finally found enough traction this year, thanks to a push from our new governor.

- Stopped included legislation that would have reduced penalties for sex offenders and allowed violent felons to seek early release.

- Prevented the state from having the power to decertify county sheriffs elected by the people.

Affordability

- Stopped the pay-per-mile tax

- Successfully fought off another attempt to increase property taxes by lifting or eliminating the 1% cap on the annual growth of property-tax rates.

- Made it easier to build more housing through zoning reform.

Better for education and children

- Kept the majority from lifting the 10-year-old cap on college tuition growth

- Ended some of the unnecessary regulation that makes childcare even harder to afford.

- Protected new mothers receiving Medicaid by preserving 12 months of postpartum maternity care.

- Prevented children from being exposed to a harmful, inappropriate far-left agenda in school.

Bonus: We stopped the “initiative-killer bill” which would have put unreasonable requirements on people gathering signatures on initiative petitions.

Majority balances budget

on backs of working families

There’s much to be said about both budgets, and because the final operating budget was negotiated in secret by a handful of Democrats and wasn’t seen by anyone else until Saturday, we’re still learning what all is in it. So for now, here’ s a quick summary:

- Watch for your property taxes to go up, because school districts are now authorized to pursue bigger local levies. Funding our K-12 schools is the paramount duty of state government, and Democrats shouldn’t be pushing more of that responsibility down to the district level, but they are.In its way, this is even worse than the straight-up property-tax increase they pushed, then abandoned — because it also sets the state up for another education-funding lawsuit (like the landmark McCleary decision of 2012) that could mean even more tax increases down the road.

- The expanded sales tax on services ($2.6 billion) — which applies to cable and streaming TV, for instance — and the increase in the business tax (nearly $6 billion) will eventually end up at the consumer level, one way or another.

- As Republicans predicted, the income tax on capital gains is already going up, after just two years’ of collections. The death tax is also going up, with the increase being retroactive to the start of this year!

- One of the tax bills in the Democrats’ package would slap a business tax on self-storage rental companies, and more… which again, will trickle down to consumers. It’s like they looked under about every rock they could turn over in search of more money.

- In all, the tax package means a $9.6 billion increase in state-level taxes, which becomes $12.5 billion when the property-tax increase and the local effect of the sales-tax increase are factored in.

- On top of all these taxes, the majority doubled childcare co-pays and tripled the per-bed license fee for nursing homes.They also raised the cost of hunting and fishing licenses by 38%, and added 50% to the cost of the annual Discover Pass. The bizarre thing is that the Democrats expect the higher fees will reduce sales, so are they just — as the saying goes — taxing behavior they want to discourage? Do they want fewer people to visit state parks and use boat launches?

Governor Ferguson said late in the session that he didn’t want to see tax increases that hit working families. If he backs that up by using his veto pen on the higher property and sales taxes in this new budget, there’s a chance legislators could be called back for a “special” session of the Legislature. We’ll have until May 20 to find out.

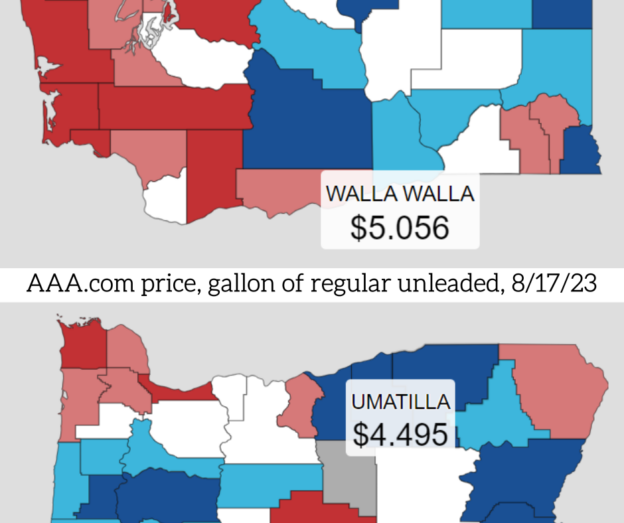

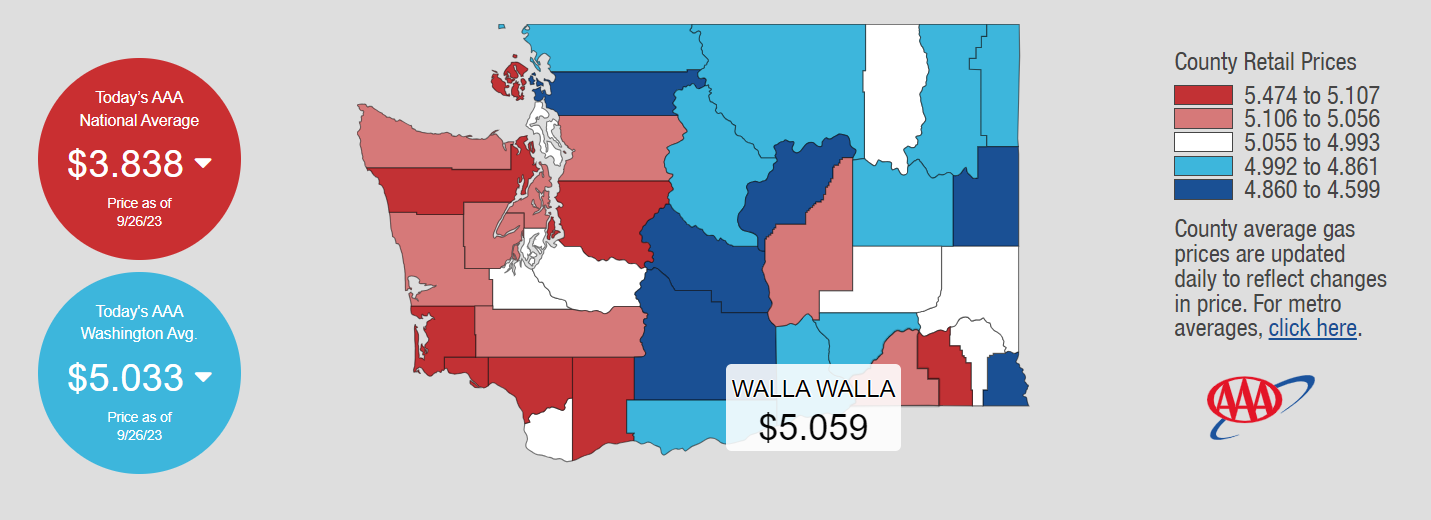

Higher taxes on gas, diesel coming

The new transportation budget for 2025-27 provides funding to keep important projects going in the face of higher labor and material costs.

While those projects include ongoing improvements to U.S. Highway 12 in our district, I could not vote for the budget because of the fuel-tax increases and weight-fee increases tied to it.

Although it’s been nearly a decade since the state portion of the gas tax went up, and another six cents per gallon may not sound like much, the tax on diesel will go up twice as much: six cents more now, then another 3-cent increase each of the next two years.

It isn’t clear why diesel is getting hit harder, unless the environmental activists on the Democratic side of the aisle had a role, but another 12 cents per gallon will obviously add to the cost of anything hauled by big trucks.

To be fair, though, the gas tax does pay for highway projects. It’s projected that by 2028, two of Jay Inslee’s favorite laws — the Climate Commitment Act and the low-carbon fuel standard — will add 30-plus cents to fuel costs all by themselves, and those don’t pay for projects to make our roads safer.

Capital budget brings variety

of investments to 16th District

The third of the three budgets adopted Sunday is the budget that funds school construction, community projects and much more: the capital budget. The broader details are in the news release Sen. Mark Schoesler and I issued that day.

Here’s a summary of the local projects funded in the new capital budget:

- Columbia Basin College – $54.5 million to replace the Performing Arts Building. The “P Building,” dates to 1971 and is home to the college’s School of Arts, Humanities and Communication.

- Kahlotus and Prescott school districts – $6 million to each district for modernization projects.

- Walla Walla environmental cleanup – $3.5 million from the Model Toxics Control Account for monitoring/cleanup of soil contamination underneath the Chevron station downtown.

- Walla Walla Water 2050 plan – $2.4 million toward this water-management plan.

- Walla Walla County courthouse – $2 million for historic preservation.

- Franklin County Fire District 2 – $1 million to complete the Kahlotus station.

- Lions Park Community Center, College Place — $1 million toward the ongoing project to renovate the park and build a new community center. It’s the second straight time this project has received capital-budget support.

- Mid-Columbia Children’s Museum — $1 million

- Port of Walla Walla – $773,000 for Tri-Cities Intermodal cargo handling.

- Christian Aid Center – $160,000 for Walla Walla rescue mission.

The capital budget, like the operating and transportation budgets, will go into effect July 1. Most of the other bills passed this session will take effect July 27, which is 90 days from the end of the session.

***

SAVE THE DATE — Saturday, May 31

16th District town hall meetings

***

Late in the session, as more bills came up for deciding votes, it was common for senators to step out of the chamber for interviews with the news media. This was for a Seattle TV station about a public-safety bill.

***

I am working to make living in our state more affordable, make our communities safer, uphold our paramount duty to provide for schools, and hold state government accountable. I’ll work with anyone who shares those goals and wants to find solutions.

Please reach out to my office with your thoughts, ideas and concerns on matters of importance to you. I am here to serve and look forward to hearing from you.

Sincerely,

Perry Dozier

State Senator

16th Legislative District