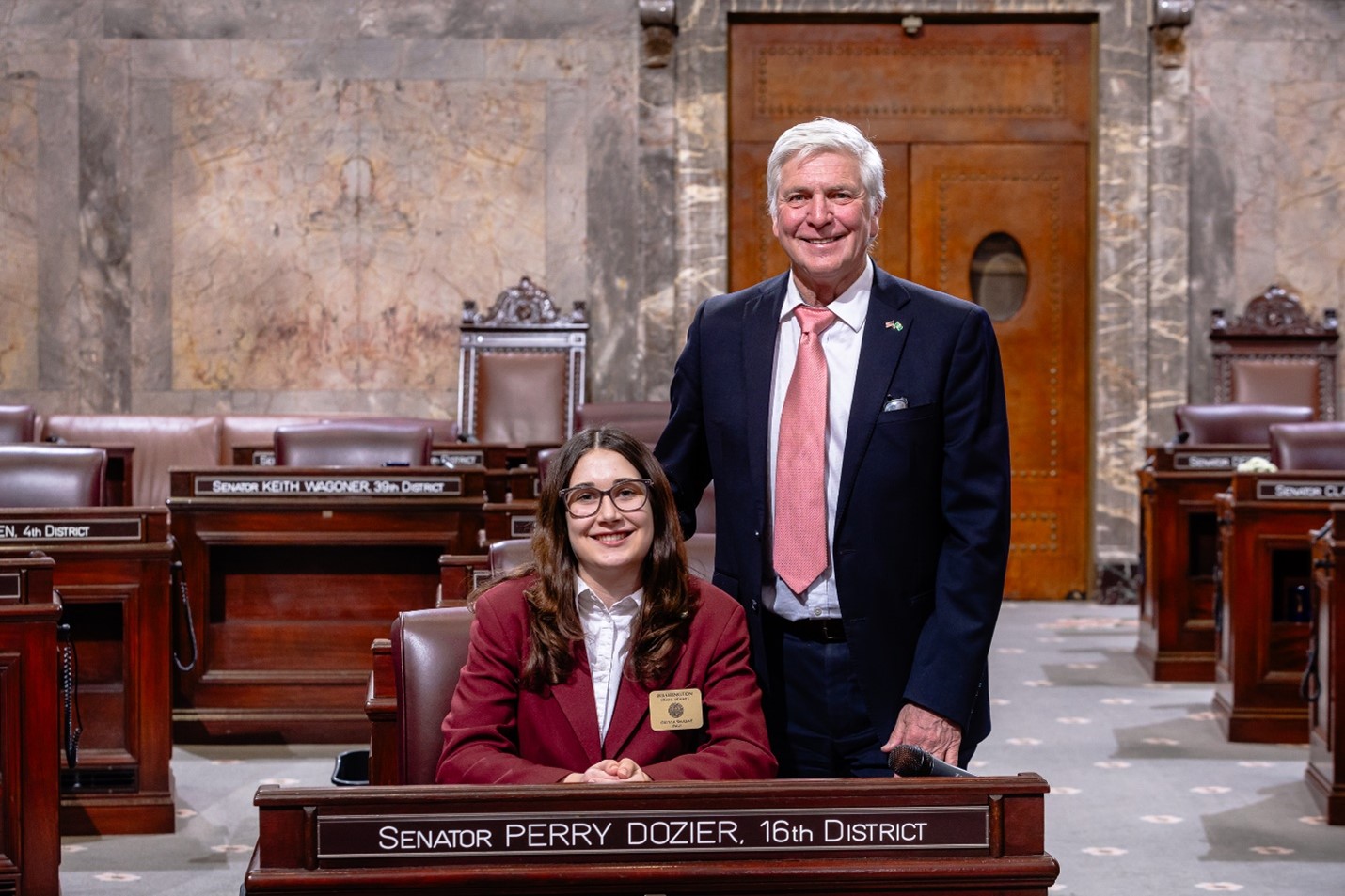

Joining me at the recent graduation ceremony at the state prison in Connell were, from left: Denise Kammers, the Dean of Corrections Education for Walla Walla Community College; Dante Leon, WWCC Vice President of Instruction; Dr. Chad Hickox, WWCC President; Ricardo Chavez, WWCC Director of Adult Basic Education for Corrections Education; Hanan Al-Zubaidy, Associate Director for Corrections Education from the State Board for Community and Technical Colleges (front); Dr. Allen Sutton, WWCC Director of Connection and Belonging (back); Lauren Reed, WWCC Director of Education Operations at CRCC; and state Representative Alex Ybarra, from the neighboring 13th Legislative District.

Joining me at the recent graduation ceremony at the state prison in Connell were, from left: Denise Kammers, the Dean of Corrections Education for Walla Walla Community College; Dante Leon, WWCC Vice President of Instruction; Dr. Chad Hickox, WWCC President; Ricardo Chavez, WWCC Director of Adult Basic Education for Corrections Education; Hanan Al-Zubaidy, Associate Director for Corrections Education from the State Board for Community and Technical Colleges (front); Dr. Allen Sutton, WWCC Director of Connection and Belonging (back); Lauren Reed, WWCC Director of Education Operations at CRCC; and state Representative Alex Ybarra, from the neighboring 13th Legislative District.

Good things are happening — people are making their lives better

Dear Neighbor,

It’s easy for state legislators to get caught up in what’s coming out of Olympia or the “other Washington” and miss the positive things that are happening right in front of us. That’s why I’m postponing a report on some of the new laws that just took effect, in favor of sharing some recent experiences that highlight good things happening locally.

The first involves the two state prisons east of the Cascades, which are both in our 16th Legislative District: the Washington State Penitentiary in Walla Walla, and Coyote Ridge Corrections Center in Connell.

Walla Walla Community College has education and training centers at both facilities. Each offers a variety of programs from basic education to college degrees, mostly AAS (Associate of Applied Science).

WWCC President Chad Hickox attended one of the legislative town hall meetings we held after the session, and extended an invitation to attend the upcoming graduation ceremonies at each institution. It wouldn’t have been right to choose one over the other, so I went to both. CRCC’s was on July 17, and the WSP graduation was July 23.

These were specifically for minimum-security students who had completed a program this year: high-school equivalency, automotive mechanics technology, carpentry or business.

I appreciated meeting the graduates, their families, and the staff, and enjoyed hearing their stories. While I’m a firm believer in holding people accountable when they are convicted of crimes, and generally skeptical about the re-entry policies favored by the majority side, I also have respect for people who are making an effort to change their lives instead of just doing their time and falling back into the same old lifestyle when they return to their communities.

An example of this self-improvement was the young man at Coyote Ridge who graduated in auto mechanics and had been resourceful enough to obtain a grant to get tools that he’ll be able to use when he gets out in a matter of months. You can’t help but cheer for him, or for the young man at WSP whose criminal troubles began after dropping out of high school but now wants to build on the degree he earned through WWCC by attending Eastern Washington University.

Someone expressed interest in starting a non-profit that could help support inmates after their release, to get them off to a better start on the outside. And when I met a graduate at WSP who had been in correctional facilities since he was a youth, I took the opportunity to ask what he thinks of the “JR-to-25” policy that basically keeps offenders in state-run juvenile facilities for several years after they turn 18, even though that has led to overcrowding and other safety and security concerns.

And let me tell you, as a member of the Senate committee on K-12 education, seeing guys in their 40s and 50s getting their high-school equivalency certificates was a stark reminder of what “basic” education means – and how we have work to do to address chronic absenteeism in our schools and increase the graduation rate.

Of course, there were unavoidable reminders at WSP that we were inside a correctional facility. Still, the ceremonies there and at CRCC did a great job of celebrating the accomplishments of these men in preparing for another chapter of their lives. It was moving to hear them talk about their perseverance, and see those smiles as they took part in the traditional tassel-flipping at the end. It was as uplifting and full of hope as any graduation I’ve attended.

That made the note my office received on July 24 from the WSP director of education all the more special. It included this about the reaction of the graduates:

“Many of them expressed varying levels of disbelief that a government official actually showed up…they are accustomed to hearing that people “might” come, and often see that fail to materialize…so, it had a positive impact and I thought he should know that. We appreciate his support and hope that he felt even a portion of the inspiration from this event, that we feel on a daily basis in our quest to change lives for our students and the communities that they eventually become a part of.”

I certainly did feel inspired, and that brings me to the visit I recently made to Hope Street House, a “sober living” home for women in Walla Walla. It’s been in the news over the years, like when the lease was signed with St. Paul’s Episcopal Church and when its first resident was accepted in 2021; my visit late this past month happened because some of the residents had invited me when we met at the Capitol during this year’s session.

If you like stories about people who have struggled but are getting their lives together, it would be hard to do better than my experience at Hope Street. It’s a great facility and a wonderful asset to the community. I’m grateful to Chloey for asking if I would visit, because you never know when I’ll have an opportunity in Olympia to be an advocate for resources like this and the good works of the people who make them possible.

With that in mind, if you know of more inspirational things happening in our area — especially examples of people working to make their lives better — please let me know!

Drought conditions = higher fire risk, at a bad time

According to this drought monitor map, most of the 16th Legislative District is experiencing a moderate drought — with the remainder being one step better (“abnormally dry”) or worse (severe drought) on the scale.

It’s worse still to the east of us, with parts of Whitman, Asotin and Garfield counties considered to be in extreme drought. That’s as bad as it gets, and can affect crop yields and cause toxic algae blooms.

According to drought.gov, we had the third-driest June on record since 1895 — which probably has something to with how Washington had the seventh-driest January since that same year.

This is happening as many of us are harvesting wheat, and as farmers and firefighters know, the conditions increase the risk of wildfire. I’m aware of several wheat fields catching fire, one of them about three miles from our house earlier this week – and a farmstead was also lost. Let’s hope we get through harvest and the rest of the heat of summer without losing more crops or equipment. Farming is enough of a challenge as it is!

***

I am working to make living in our state more affordable, make our communities safer, uphold our paramount duty to provide for schools, and hold state government accountable. I’ll work with anyone who shares those goals and wants to find solutions.

Please reach out to my office with your thoughts, ideas and concerns on matters of importance to you. I am here to serve and look forward to hearing from you.

Sincerely,

Perry Dozier

State Senator

16th Legislative District

EMAIL: Perry.Dozier@leg.wa.gov

OLYMPIA PHONE: (360) 786-7630

OLYMPIA OFFICE: 342 Irving R. Newhouse Building

MAILING ADDRESS: P.O. Box 40416, Olympia, WA 98504